Should Nirmalaji Be Worried?

The deficit stood over Rs 8 trillion in the first seven months of the current financial year.

Non-tax revenues, comprising transfers from the RBI and dividends of the public sector units, shored up the Centre’s revenues..

Collections from major central taxes — corporation, central goods and services tax (CGST), excise duty and customs duty — before devolution to the states declined in October this financial year, leading to the total tax receipts dropping by 1.2 per cent at Rs 2.15 trillion compared to Rs 2.18 trillion in the corresponding month of 2022-23.

It was mainly personal income tax that saved the day for tax receipts. Collections under this head rose 31.1 per cent at Rs 69,583 crore (Rs 695.83 billion) in the month against Rs 53,057 crore (Rs 530.57 billion) a year ago, according to data released by the Controller General of Accounts.

Corporation tax declined by over 13 per cent at Rs 30,686 crore (Rs 306.86 billion) in October this year compared to Rs 35,279 crore (Rs 352.79 billion) in the same month of 2022-2023.

Customs duty halved to Rs 18,200 crore (Rs 182 billion) against Rs 36,659 crore (Rs 366.59 billion), while union excise duty fell 1.2 per cent at Rs 25,457 crore (Rs 254.57 billion) against Rs 25,778 crore (Rs 257.78 billion) over this period.

The much-talked buoyant GST collections also could not deliver much to the government. The CGST was down 2.4 per cent at Rs 70,510 crore (Rs 705.10 billion) against Rs 72,219 crore (Rs 722.19 billion).

When it comes to cumulative figures, it was only the union excise duty which fell in the first seven months of the current financial year over that in the corresponding period of 2022-2-23.

The duty yielded 9.3 per cent less revenue at Rs 1.5 trillion against Rs 1.6 trillion over this period.

As such, overall tax collections rose around 14 per cent at Rs 18.3 trillion during April-October of the current financial year against Rs 16.1 trillion during the corresponding period of FY’23.

The CGA figures are generally used to gauge government finances. In this regard, the fiscal deficit of the Centre hinged on central taxes after devolution as well as other receipts and expenditures.

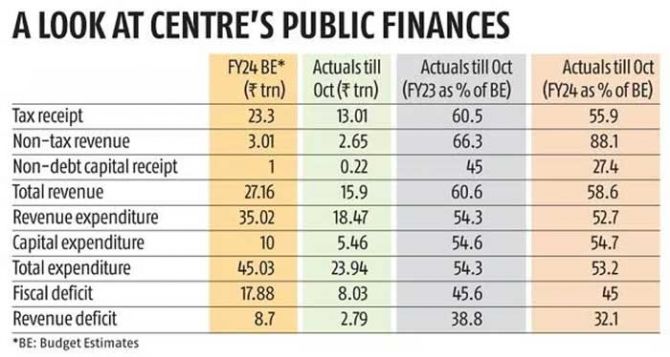

The deficit stood at a bit over Rs 8 trillion in the first seven months of the current financial year, constituting 45 per cent of the Budget Estimates (BE) against a little higher 45.6 per cent during a year ago period.

Tax revenues of the Centre, post-devolution to the states, was over Rs 13 trillion, accounting for 55.9 per cent of the BE, way lower than 60.5 per cent during the same period of 2022-23.

Non-debt capital receipts, primarily comprising divestment of public sector units, yielded just Rs 22,990 crore (Rs 229.9 billon) during April-October this year, representing 27.4 per cent of the BE against way higher 45 per cent in the year-ago period.

It is mainly non-tax revenues, mainly comprising transfers from the Reserve Bank of India and dividends of the public sector units, that shored up the Centre’s revenues.

This head gave Rs 2.6 trillion to the Central kitty during the first seven months of this financial year, constituting 88 per cent of the BE against 66 per cent in the year-ago period.

As such, the Centre’s receipts stood at Rs 15.9 trillion during April-October this year, accounting for 58.6 per cent of the BE against 60.7 per cent during the corresponding period of 2022-2023.

On the other hand, expenditure stood at Rs 23.9 trillion during the first seven months of the current financial year, representing 53.2 per cent of the BE, a bit lower than 54.3 per cent in the year-ago period.

The excess expenditure over revenue — slightly over Rs 8 trillion — was the fiscal deficit of the Centre as cited above.

Capex stood at Rs 5.5 trillion, constituting 54.7 per cent of BE against 54.6 per cent in the year-ago period.

This was in sharp contrast till a month ago. Capex till September accounted for 49 per cent of this year against 45.7 per cent during the first six months of 2022-2023.

According to ICRA estimates, capex declined 15 per cent in October, FY’24 year on year.

Revenue expenditure, which is the major portion of the total expenditure, stood at Rs 15.9 trillion during the first seven months of the current financial year, representing 52.7 per cent of the BE against 54.3 per cent in the year-ago period.

The situation was a bit different till September. Revenue expenditure constituted 46.5 per cent of BE in the first half of this financial year, marginally higher than 46.3 per cent in the year-ago period.

The Cabinet extended free food grains to over 810 million people for the next five years last week, beginning the new year, which will cost an additional Rs 6,000 crore in the last quarter of the current financial year.

ICRA chief economist Aditi Nayar said considering the additional economic cost on this count, the higher subsidy on LPG, the Nutrient-based Subsidy rates on P&K fertilisers for the ongoing rabi season, and the additional amount likely to be required for MGNREGS, expenditure would exceed the FY’2024 BE by Rs 0.8 to Rs 1 trillion.

“However, this sum could be matched by expenditure savings, which have ranged between an estimated Rs 1.1 trillion to Rs 2.3 trillion in recent years,” Nayar said. “As a result, we foresee a low risk of the fiscal deficit target of 5.9 per cent of GDP being breached.”

Feature Presentation: Ashish Narsale/Rediff.com

Source: Read Full Article