Fintech Lenders Gave Rs 29,875 Crore

‘The last year’s growth is a foretaste of things to come in the retail credit market.’

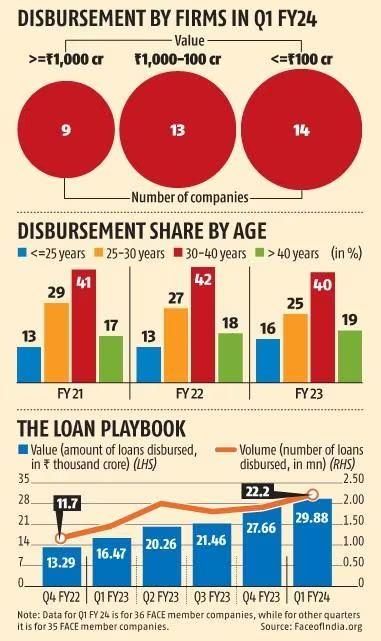

Did you know that fintech lenders gave out Rs 29,875 crore (Rs 298.75 billion) in loans in Q1 of financial year 2023-2024 (Q1 FY24), up year-on-year by 81.41 per cent

This is contrary to the widely held view that these firms have been caught flat-footed after Mint Road came out with a raft of regulations to cut down on regulatory arbitrage, and put in place a best practices framework.

A caveat is in order though: The latest lending data put out by the Fintech Association for Consumer Empowerment (FACE) is linked to the booksize of its members; as it goes up, so do the credit numbers.

That said, this is the only dataset we have on digital lending; and FACE is in line to get approval from the Reserve Bank of India to be a self-regulatory organisation (SRO).

Are we on the cusp of Version 2.0 of this game?

“You may label it as you want. The reality is last one year’s growth is a foretaste of things to come in the retail credit market,” says Ranvir Singh, co-founder and CEO of Kissht, a digital lending platform which claims a monthly run-rate close to Rs 1,800 crore (Rs 18 billion).

What you are now seeing in fintech lending mirrors the growth in the broader consumer credit market during the first quarter of 2023 (calendar year, Q1 CY23).

According to TransUnion CIBIL, unsecured credit portfolios continued to scale growth backed by small-ticket loans.

That credit demand in the quarter ending March 2023 remained robust, growing across almost all product types.

Its ‘Credit Market Indicator’ for Q1 CY23 touched 102, up from 94 in the same period in 2022.

We are some distance away before granular data, like in the case of legacy regulated entities (REs), is available, but fintech lenders are taking the game to a new audience.

“We primarily serve mid-India, and the mid-income segment. That is with an annual income of around Rs 6 lakh which is not where private banks operate,” says Madhusudan Ekambaram, co-founder and CEO, KreditBee.

Nor “are private banks in the Tier-III to IV cities in which we operate. State-run banks are there, but we provide better service to this segment.”

It’s almost a free-run for KreditBee in these markets.

What’s driving the resilience in digital lending?

Foremost is the strong customer demand and preference to take credit digitally.

“Over time, fintech lenders have won customers’ trust by serving their needs with appropriate customer protection measures, including simple, understandable disclosures, data privacy, grievance redress, and recoveries,” notes Sugandh Saxena, CEO, FACE.

Lenders are raising the bar for customer experience with a new code of conduct and convergence on the need for self-regulation.

This is far cry from what prevailed as late as December 2022, when RBI Deputy Governor Rabi Sankar referred to an ‘unexpected regulatory challenge which one may characterise as compliance aversion.’

Financial entities traditionally subject to regulation understand that it serves the larger objective of systemic stability and development.

But entities outside the financial space are still learning to adapt to a regulated environment.

Consequently, their initial reaction to regulation is objection.

“The regulatory changes have strengthened the digital lending ecosystem and not affected the business adversely. Growth has been robust both in retail and to MSMEs (micro, small and medium),” says Jatinder Handoo, CEO, Digital Lenders Association of India (DLAI) — another applicant to be an SRO.

The business has borne the brunt of regulatory changes –long overdue.

In June this year, Mint Road’s re-imagined first-loss default guarantees (FLDGs) — financial buffers offered by unregulated fintechs to REs against defaults on loans originated by the former — by capping it at five per cent of such exposures.

This was expected to arrest the tendency of REs going soft when underwriting credit, taking comfort from the FLDGs.

In some arrangements, these were as high as 75 per cent of the loans originated.

Mint Road’s step was seen by many as being a dampener for lending to the new-to-credit (NTC) segment with no credit histories which has grown hugely in recent times.

TransUnion study had it that 31 million Indian consumers debuted with credit products through the first nine months of 2022, on the back of 35 million in 2021.

Millennials (those born between 1980 and 1994) accounted for 42 per cent of fresh credit and Gen Z (born between 1997 and 2012 came in next at 29 per cent), according to the Pew Research Centre, and the US Census of 2022.

An aspect that needs to be closely watched is the behaviour of banks — private in particular — on the retail banking front.

Mint Road has sought details from some of the bigger among this lot on their retail book — RBI inspectors have taken note of lending to customers with a credit score less than 700.

This has to be read in with the observation in the Report on Trend and Progress of Banking in India (2021-2022): ‘In recent years, Indian banks appear to have displayed ‘herding behaviour’ in diverting lending away from the industrial sector towards retail loans. The decline was evident across bank groups. Empirical evidence suggests that a buildup of concentration in retail loans may become a source of systemic risk.’

It’s too early to say if banks may pause and relook at their retail lending here on.

Either way, one thing is certain: Fintech lenders appear to be in a sweet spot — hopefully, they will not go overboard playing this game.

Feature Presentation: Aslam Hunani/Rediff.com

Source: Read Full Article